Get my

Homeowners & Renters Insurance Hickory, North Carolina

When you need a home insurance policy, it is important to find one that fits your needs and lifestyle. If something were ever to happen in the event of an unfortunate tragedy or accident - whether on purpose by a disaster like fire damage from stovetop overload; accidentally while doing chores around kitchen range explosion--we’re here for all those moments when life feels unforeseeable! You can rest assured knowing Romeo Heatherly Insurance Services is an independent insurance agency that has policies tailored specifically towards renters as well as homeowners who own property at risk, such as second homes offsite properties where the jewelry may be stored.

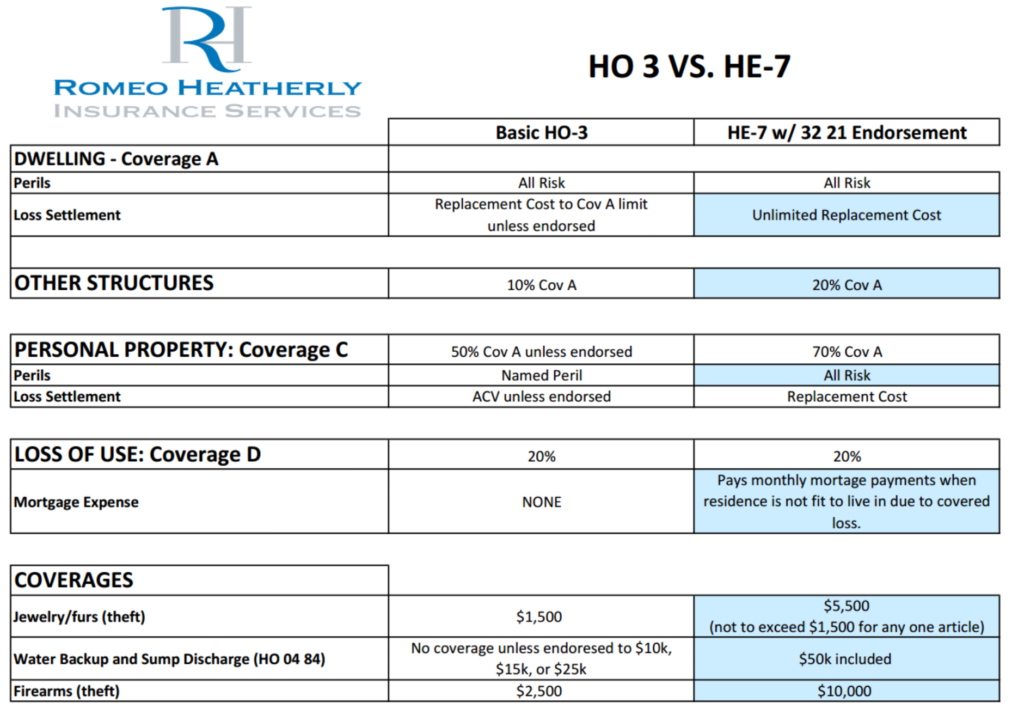

Homeowners in North Carolina can purchase an enhanced policy, also known as a HE-7. This provides superior coverage to the standard homeowners’ policies available from other companies because it meets all requirements for this type of document and has increased benefits too!

Here’s why you should consider an enhanced HE-7 homeowner’s policy instead of the basic ones:

Peace of Mind Insurance Solutions

The majority of home insurance policies cover many disasters, including fire and theft. Many also offer coverage for your physical structure and other structures on the property, such as garages or greenhouses, to name just two examples; this includes personal property too - things like furniture, appliances, clothing, etc. Coverage typically extends expenses incurred when one's utility is lost due to an incident at their house--so you're covered, whether it be water flood damage (national flood insurance program) caused by a heavy rainstorm.

Other Insurance Solutions:

Still, looking for an insurance agency to protect your home further? You’re in luck. We have just the thing for you! The North Carolina Enhanced Homeowner's Policy will provide an added layer of protection and peace of mind knowing that you're covered if something goes wrong with your home or property. To learn more about this policy (including its benefits), give us a call today.

Frequently Asked Questions

How can an independent insurance agency help with my home insurance?

As an independent insurance agency or better known as a broker, Romeo Heatherly Insurance works with multiple insurance companies to find you the best rate that meets your individual needs. We work with such companies as:

- Nationwide

- Homeowners of America

- Utica

- AAA

- Heritage

- Progressive

- UPC

- Foremost

- Allstar

- First Mutual

- Zurich (Offering builders risk)

How can I get a quote for North Carolina homeowners or renters insurance?

I just bought a new home in North Carolina. How do I pay for homeowners insurance?

I started using my house for short-term rental (air-BNB), do I need different insurance?

Does North Carolina homeowner’s insurance cover flooding?

What is the average cost of homeowners insurance in North Carolina?

How much of my watches, valuables, and jewelry are covered?

Does regular home insurance cover flooding?

I bought a new home, how do i pay for home insurance?

What does North Carolina renters insurance cover?

What is the difference with Home insurance with an insurance agent vs. independent insurance agency?

What is the best cheap renters insurance in NC?

AAA

ASI

Attune

First Mutual

Foremost

Heritage

Homeowners of America

Millers Mutual

Nationwide

Progressive

RPS Insurance

Ryan Turner

UPC Insurance

Utica Insurance

Zurich